Consult our academic advisor

(+91)8929922369

Consult our academic advisor

Consult our academic advisor

Consult our academic advisor

3 days of On-Campus module

.png)

IIM Nagpur Alumni Status

.png)

Get a Certificate of Completion by IIM Nagpur

Live Online Lectures Every Sunday IST 10:00 AM to 1:00 PM

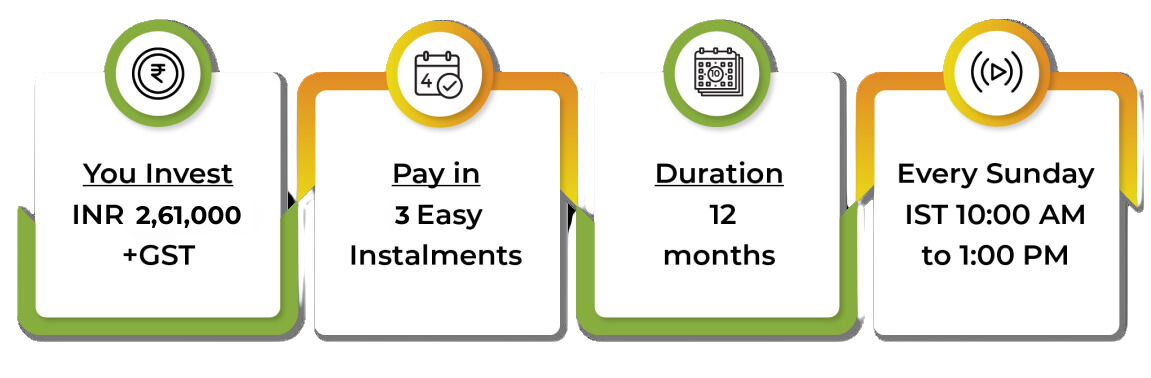

Fees

Duration

Eligibility

In today's dynamic business landscape, the role of the Chief Financial Officer (CFO) has evolved beyond traditional financial stewardship. CFOs are now expected to drive strategic initiatives, spearhead digital innovation, and uphold ethical governance standards. The Post Graduate Certificate Programme for Emerging CFOs is meticulously crafted to meet these evolving demands.

Utilizing a proven pedagogy developed by the esteemed faculty at IIM Nagpur, refined through industry Programmes offered over the past two decades.

Successful completion of the Programme bestows participants with the prestigious IIM Nagpur Alumni status.

Participants will experience 3 days of Intensive Learning at the IIM Nagpur Campus.

The Programme incorporates insightful use cases and a discussion-led, hands-on learning approach, culminating in a Capstone Project.

The Programme facilitates networking opportunities with industry peers.

Dr. Satish Kumar, a Professor of Finance and Accounting at IIM Nagpur, has over 18 years of teaching and research experience in prestigious institutions in India and abroad. He holds a doctorate from IIT Roorkee and qualified for the Junior Research Fellowship in 2007. His research spans Corporate Finance, Supply Chain Finance, Small Business Finance, Corporate Governance, Consumer Economics, Systematic Literature Review, and Bibliometric Analysis, with over 200 publications in top-tier journals. Dr. Kumar's excellence in research has earned him several prestigious awards, including the Basant Kumar Birla Distinguished Research Scholar Award for Social Science and Management 2023, and the Careers360 2nd Faculty Research Award 2023 for Outstanding Research in Economics, Econometrics, and Finance. Most recently, he was honored with the AIMS International Outstanding Management Researcher Award in March 2024.

Prof. Satish Kumar

Dr. Prashant Gupta is a Professor at IIM Nagpur and has previously served at IIM Trichy. With over 25 years of experience blending industry and academics, he has held various administrative roles such as Dean, Chairman Admissions, and Program Director at different institutions. Dr. Gupta has conducted training programs for over 5000 executives from major PSUs like ONGC, IOC, and NTPC, and organized international training programs for more than 1000 executives from 55 countries. He has numerous national and international research publications and has presented at conferences worldwide. He is on the Advisory Board of three companies and the Economic Council of India (ECI). Trained by Ivy Business School and the International Finance Corporation, he specializes in Corporate Governance and sits on various academic and professional boards, including the Accounting Standard Board (ICAI) and the Bureau of Indian Standards' committee on Sustainable Finance.

Prof. Prashant Gupta

Established in 2015, IIM Nagpur aims to become a leading management institution by offering high-quality education, research, and industry engagement. Its mission is to cultivate value-driven leaders and global managers equipped with strong conceptual foundations and analytical skills. With a focus on bridging the gap between theory and practice, IIM Nagpur emphasizes constant industry engagement and offers Executive Education programmes designed to enhance managers' capabilities and prepare them for greater challenges in their careers.

25th May

May 2025

The pedagogy of the course is designed to foster interactive and practical learning experiences:

Participants are expected to attend all sessions of a given course. Participants may take leave on account of emergencies, subject to the approval of the Programme Coordinator. However, a 75% minimum attendance requirement would be considered for the final grading.

| FEES TOWARDS | DEADLINE | AMOUNT |

|---|---|---|

| Registration Fee | Payable at the time of registration (excluding GST) | Rs. 3000 |

| Programme Fee (1st Installment) | Payable within 15 days of receiving the offer letter (excluding GST) | Rs. 88,000 |

| Programme Fee (2nd Installment) | Payable within 3 months of admission (excluding GST) | Rs. 88,000 |

| Programme Fee (3rd Installment) | Payable within 6 months of receiving the offer letter (excluding GST) | Rs. 82,000 |

| Total Fees Exclusive of GST | Rs. 2,61,000 |

Get the guidance you need to make sure that you are making the right decision here. Consult VCNow’s Senior Programme Advisors at (+91) 8929922369.